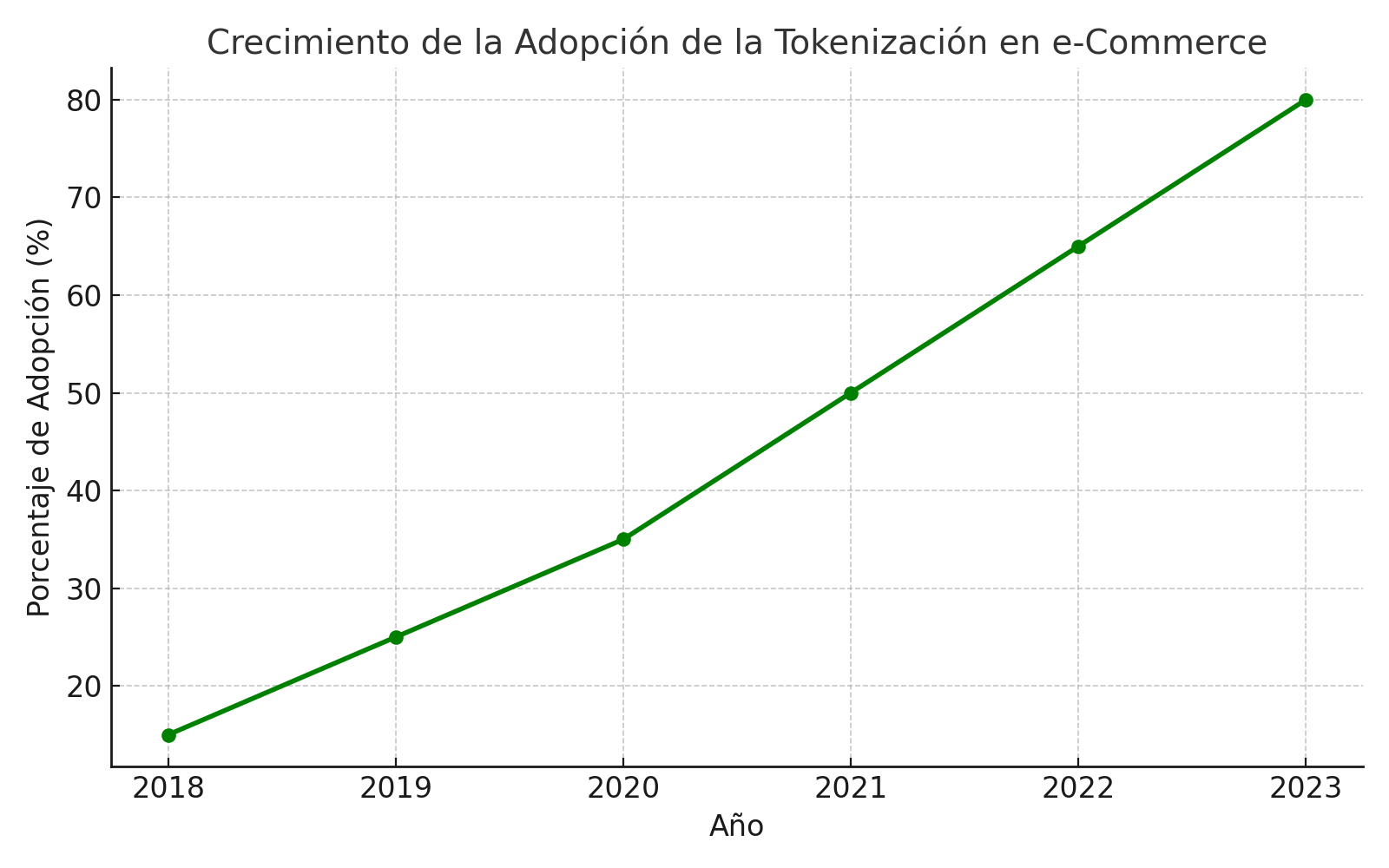

The tokenisation is revolutionising e-commerce, bringing an additional layer of security and efficiency that is transforming the way we transact online. This technological advancement not only benefits consumers, but also offers significant advantages for entrepreneurs in the sector. e-commerce. We will explore in detail how tokenisation is driving growth and trust in digital commerce, and how this technology has the potential to redefine transactions and the protection of sensitive data.

What is tokenisation?

The tokenisation is a security process that replaces sensitive information, such as credit card numbers, with a unique and unrepeatable token. This token has no real value in itself and does not reveal the original information, but is used in transactions as a substitute for the original data.

Imagine that the numbers on a credit card are transformed into a random code, such as "XJ29K7L1". This code, or tokenis what is stored and transmitted, rather than the original data. Only the system that generates the token can connect it to the card information. Thus, an additional layer of protection is added.

The tokenisation process not only increases security, it also optimise transactions by minimising the exposure of sensitive data and facilitating safer, faster and more efficient payments on e-commerce platforms.

Benefits of tokenisation for e-commerce

Improving security

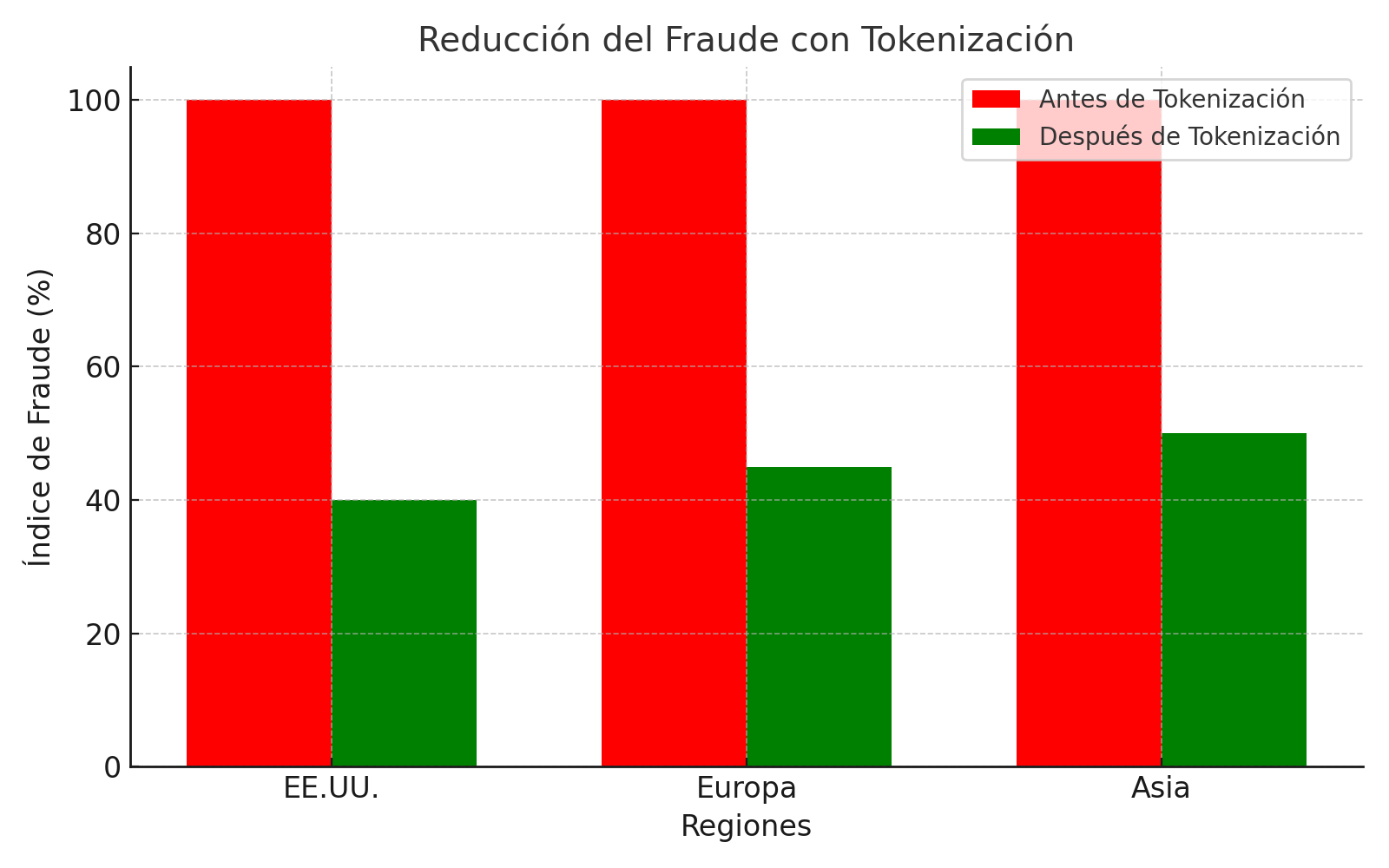

One of the main benefits of tokenisation is the significant improvement in the security of transactions. Instead of credit card data travelling between merchants and financial institutions, tokens are transmitted instead. These tokens cannot be reused to commit fraud, as they are unique to each transaction.

According to Visathe tokens have prevented over 650 million in fraud during the year 2023 (BlockApps Inc.). This level of security has been a key solution for many e-commerce companies seeking to protect customer information and minimise the risk of cyber-attacks.

Increased customer confidence

By providing a more secure payment environment, companies can increase the confidence of your customers. Consumers, increasingly aware of security risks in the digital world, are looking for e-commerce platforms that prioritise the protection of their data.

Tokenisation offers consumers the opportunity to peace of mind necessary to shop online without fear of your personal information being compromised. This not only improves the customer experiencebut it also creates a long-term relationship between brands and buyers, promoting the Loyalty.

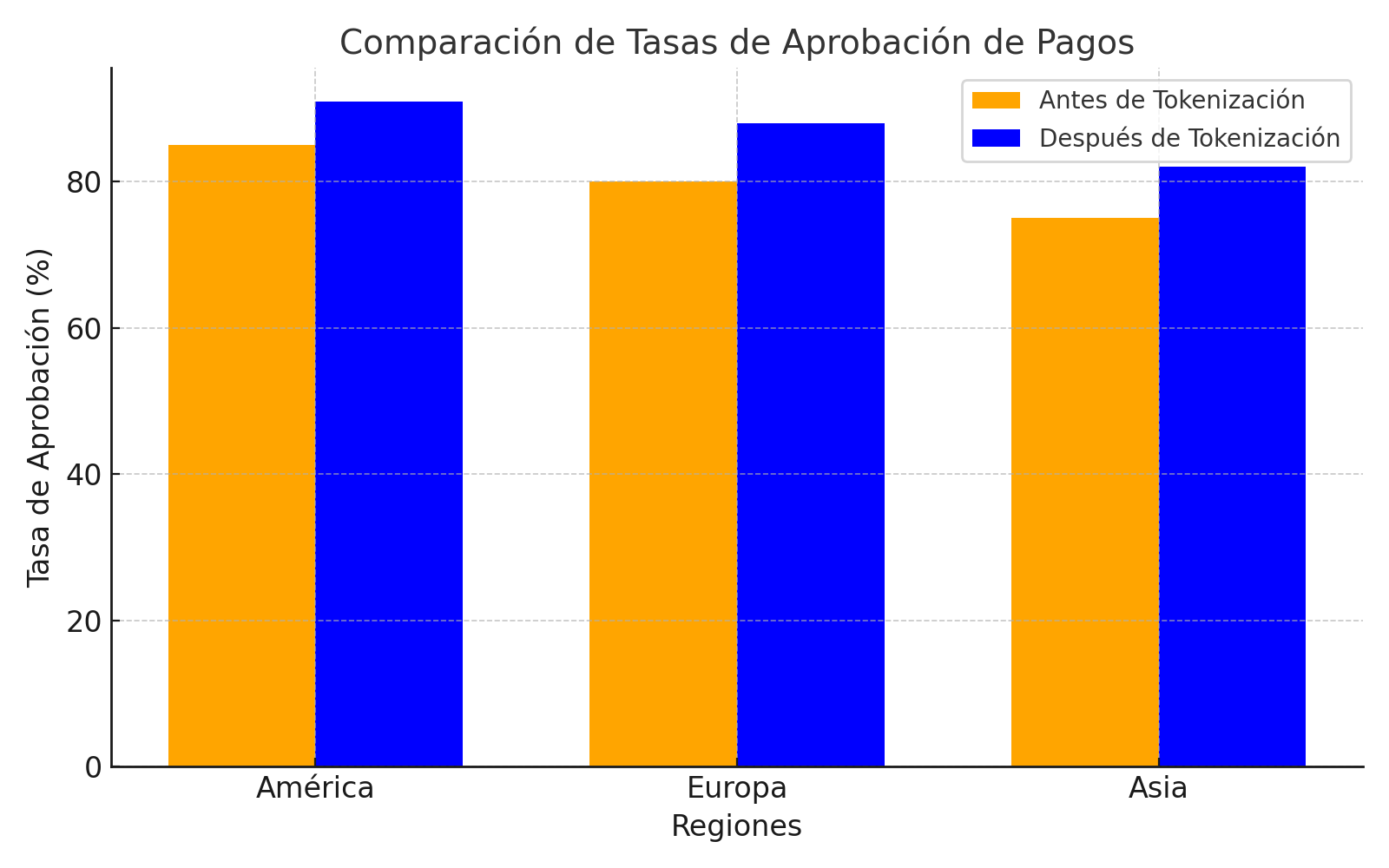

Improved payment approval rates

In addition to improving security, tokenisation also has a positive impact on the payment approval rates. According to a report by VisaThe implementation of tokenisation has led to an increase of 6 points in pass rate of payments worldwide(BlockApps Inc.). This is partly due to the elimination of friction in payment processes, which benefits both consumers and merchants.

Facilitation of recurring payments

Tokenisation simplifies the recurring payments and the subscriptions. Once a customer's payment data has been tokenised, it can be reused for future payments without the need for the customer to re-enter their information each time.

This capability is particularly useful for companies that operate with subscriptions or recurring sales, such as streaming services, subscription purchases or digital product platforms. The tokenisation process ensures that the customer's data is secure while providing a smooth payment experience.

Simplified compliance

Tokenisation not only improves security and the customer experience, it also simplifies the regulatory compliance with data security regulations, such as the Payment Card Industry Data Security Standard (PCI DSS).

By reducing the exposure of sensitive data, companies can minimising risk of data breaches and reduce the costs associated with audits and compliance. This advantage is crucial for companies that handle a large volume of online transactions.

Blockchain and Tokenisation: A Secure and Transparent Future

While tokenisation already offers a higher level of security, its potential is maximised when combined with blockchain. Blockchain technology enables decentralised and transparent transactions, where tokenised data is securely stored in a distributed network, without the need for centralised intermediaries.

The combination of blockchain with tokenisation not only improves security, but also makes it easier to traceability of transactions and improves the trust between all parties involved. This is especially relevant in sectors where the verification of the data is crucial, as in the supply chain and the digital assets.

Tokenisation beyond credit cards

Tokenisation has already proven its value in protecting credit card data, but its use is not limited to credit card data. Nowadays, tokenisation is being applied to protect digital identities, medical records and other sensitive information requiring a high level of protection.

For example, in the healthIn addition, tokenisation is used to secure electronic medical records, allowing patients and providers to share information securely. This opens up a range of possibilities for the protection of personal data in any area where privacy is essential.

The impact of tokenisation in figures

The impact of tokenisation on e-commerce is reflected in impressive figures:

- Visa has issued more than 10 billion tokens since the technology was launched in 2014 (BlockApps Inc.).

- Visa tokens have generated 40 billion in additional e-commerce revenues for companies around the world.

- More from 30% of all purchases made in Spain are tokenised.

- Tokenisation has reduced fraud by as much as 60%according to recent data(BlockApps Inc.).

Concrete use cases of tokenisation

- ShopifyShopify e-commerce platform Shopify has integrated tokenisation to simplify recurring payments and improve conversion rates on its platform. Customers can make repeat purchases without having to re-enter their data, which improves both the security as the user experience.

- Amazon: Amazon has implemented tokenisation to improve the security of transactions on its global platform. Customer card data is tokenised, which protects both Amazon and consumers from potential data breaches.

- Apple Pay: Apple Pay uses tokens to replace credit and debit card numbers during transactions, adding an extra layer of security to digital purchases and protecting user privacy.

Sustainability of tokenisation

The environmental impact of technology solutions has been a growing issue of concern for many companies. As the tokenisation continues to evolve, companies are also embracing more sustainable. Some companies have started to use blockchains based on the proof-of-stakewhich significantly reduces energy consumption compared to other models, such as the proof-of-work.

These more energy-efficient blockchains allow companies to adopt tokenisation in a more efficient way. sustainablecontributing to its objectives environmental and social responsibility.

The future of tokenisation in e-commerce

The future of tokenisation promises to be even more exciting. With the continued development of blockchain technologiesIn addition to payment data, tokenisation has the potential to expand beyond payment data and into new areas, such as digital identitiesthe protection of intellectual property and the real-time data verification.

A recent survey by Visa revealed that less than a third of consumers feel in control of their personal data. Tokenisation has the potential to change this perception by giving consumers more control over what data they share, how they share it and with whom. With the tokenisation and the blockchainIn addition, consumers will be able to view, accept and revoke access to their data directly from their banking applications, giving them full control over their information.

In addition, with the combination of tokenisation and artificial intelligence (AI)In this way, companies will be able to offer highly personalised shopping experiences without compromising on the security or the privacy of consumer data. AI algorithms will be able to process tokens instead of sensitive data, ensuring that users receive personalised recommendations and targeted offers without putting their personal information at risk.

Expansion into new sectors

Although tokenisation has predominantly been used to protect financial data, its application is expanding to other industries that require protection of sensitive data. For example, in the healthIn the electronic health sector, tokenisation can protect electronic health records, ensuring that only authorised parties can access patient information. Similarly, in the digital identitiesIn addition, tokenisation can ensure the integrity and privacy of personally identifiable data.

Even sectors such as logistics and the supply chain are exploring the use of tokenisation to ensure product traceability. Through blockchain, every stage of a product's lifecycle can be tokenised, giving consumers and businesses a complete and verified view of the origin and destination of goods.

Implementing tokenisation in your business

If you are an entrepreneur in the sector e-commerce and you are interested in implementing tokenisation in your business, here are some steps you can take to facilitate the integration of this technology:

- Assess your needsBefore implementing tokenisation, it is important that you determine what type of sensitive data you need to protect and the volume of transactions you process on your platform.

- Choosing a tokenisation service providerThere are a number of reliable providers offering tokenisation solutions, such as Visa Token Service o Mastercard Tokenization Solutions. Research the options and select the provider that best suits your business needs.

- Integrating tokenisation into your payment systemWork with your provider to integrate tokenisation into your e-commerce platform. This process should not disrupt day-to-day operations and may even improve transaction efficiency.

- Train your staffMake sure your team understands how tokenisation works and how it affects payment processes. Training is essential to ensure that all staff are aligned with security best practices.

- Communicate the benefits to your customersCustomers want to know that their information is secure. Inform your customers about the implementation of tokenisation and how it improves the security of their data. This will not only increase trust in your brand, but may also attract more customers.

- Monitor and optimiseOnce tokenisation is implemented, it is important to monitor its performance and make adjustments if necessary. Work closely with your service provider to ensure that the system works optimally.

Conclusion

The tokenisation has proven to be a key technology for improving the security and efficiency of e-commerce payments. From protecting financial data to simplifying recurring transactions, the benefits of tokenisation are manifold and have a significant impact on user experience and commercial success.

As e-commerce continues to grow and evolve, tokenisation is positioning itself as an essential tool for ensuring a safe and efficient future for digital transactions. Companies that adopt this technology will be better positioned to take advantage of the continued growth of digital commerce, offering their customers a more seamless shopping experience. secure, convenient y reliable.

With the integration of blockchain, IA y tokenisationWe are entering a new era where data security and personalisation of the customer experience go hand in hand, without compromising privacy or operational efficiency. Tokenisation is not just a security measure, it is a growth strategy that enables companies to optimise their operations, build consumer trust and stay at the forefront of innovation in the electronic commerce.

Ultimately, tokenisation is much more than a trend; it is a fundamental transformation in the way we protect and process payment data. With more companies embracing this technology, we are witnessing a new era of digital commerce which is more secure, efficient y transparent than ever before.

Below you will find links to sources of interest:

- https://usa.visa.com/products/visa-token-service.html

- https://www.statista.com/statistics/1225469/cryptocurrency-adoption-rate-worldwide/

- https://www.mastercard.us/content/mccom-admin/faq-category-admin/tokenization.html

- https://usa.visa.com/partner-with-us/payment-technology/visa-tokenization.html

- https://www.telefonica.com/es/sala-comunicacion/blog/proof-stake-pos-que-es-prueba-participacion/

- https://www.aboutamazon.com/news/innovation-at-amazon/

- https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-tokenization